Soybean exports and the exchange rate puzzle

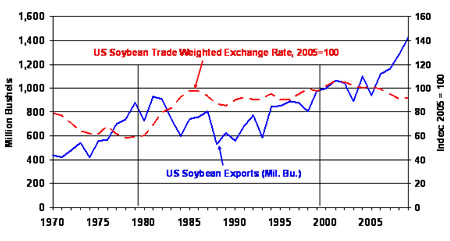

Soybeans have been the bright spot in US crop exports, increasing by 76 percent over the last 12 years after remaining variable but with a flat trend over the prior 18 years (Fig. 1). US soybean exports peaked in 1981 at 929 million bushels and did not reach that level again until 1999. The increase in US soybean exports coincides with the point at which China began to become a major factor in world soybean imports.

When looking at bulk agricultural commodity exports the conventional wisdom has held that as the US exchange rate has declined, US exports of these commodities has increased. Two weeks ago we examined corn and saw that relationship between corn exports and the trade weighted exchange rate for US corn importers was significant between 1970 and 1991 (http://agpolicy.org/weekcol/506.html). During the 1992-2009 period there is no significant relationship between the two.

US Wheat showed a similar pattern of a significant relationship between US exports and the trade weighted exchange rate for US wheat importers in the 1970-1989 period (http://agpolicy.org/weekcol/507.html). This pattern did not hold for the 1990-2009 period.

Looking at US soybean exports and the trade weighted exchange rate for US soybean importers, we see the expected mirror image in the 1970-1979 period, and statistical tests show that the relationship is significant (Fig. 1).

Figure 1. US trade weighted exchange rate for US soybean importers, 2005=100, and US soybean exports (million bushels), 1970-2009. Data source: USDA.

Over the next 20 years (1980-1999), the mirror image is hard to discern in Figure 1 and statistical tests confirm the lack of significance in the relationship between US soybean exports and the trade weighted exchange rate for US soybean customers.

Unlike what we saw with corn and wheat, the mirror image shows back up in the 2000-2009 period and the relationship is statistically significant. During this period China’s share of US soybean exports rose from 19 percent to 56 percent as China allowed the renminbi (Chinese currency) to strengthen somewhat compared to the US dollar.

Of course, other factors are always at work as well—perhaps more so in present-day China than most other places and other times. Of particular importance are China’s impressive economic growth and the attendant societal movement toward more protein-rich diets. But there were also decisions by the Chinese government to remain self-sufficient in traditional staple crops and newly accelerating meat demands.

Soybeans did not make the self-sufficiency list. While more processed soybeans are needed to supply the protein portions of livestock feed rations, China chose to use international markets to procure their ever increasing soybean needs. US soybean producers have benefited, as have South American soybean producers.

In the next few years, we expect the US government to continue to pressure the Chinese to allow the renminbi to gain additional strength in relationship to the US dollar as a means of correcting some of the trade imbalance between the two countries.

If asked to name one country that could dramatically affect US agricultural exports via future changes in currency exchange rates and public policy, China would likely be the country that most would name. It will be interesting to see what time reveals.

Daryll E. Ray holds the Blasingame Chair of Excellence in Agricultural Policy, Institute of Agriculture, University of Tennessee, and is the Director of UT’s Agricultural Policy Analysis Center (APAC). (865) 974-7407; Fax: (865) 974-7298; dray@utk.edu; http://www.agpolicy.org. Daryll Ray’s column is written with the research and assistance of Harwood D. Schaffer, Research Associate with APAC.

Reproduction Permission Granted with:

1) Full attribution to Daryll E. Ray and the Agricultural Policy Analysis Center, University of Tennessee, Knoxville, TN;

2) An email sent to hdschaffer@utk.edu indicating how often you intend on running Dr. Ray’s column and your total circulation. Also, please send one copy of the first issue with Dr. Ray’s column in it to Harwood Schaffer, Agricultural Policy Analysis Center, 309 Morgan Hall, Knoxville, TN 37996-4519.