Corn exports over the last six decades—promise vs performance

The continuous growth in crop exports has long been the great hope that would sustain unending prosperity for US farmers. In some ways, ever increasing exports might be seen as a market-based solution to the farm income problem that would obviate the need for much of agricultural commodity policy beyond export promotion.

This year’s significantly higher crop prices are certainly a welcome respite from a years-long stretch of low prices that has led to a significant increase in farm bankruptcy filings.

The trigger for this year’s higher prices? In a word: exports. Exports of the two most widely grown crops in the US increased significantly.

Soybean exports are projected to increase by 548 million bushels or 32 percent. Corn exports are projected to increase by 822 million bushels or 46 percent.

Given our column of last week in which we argued that high prices not only cure high prices, they clobber high prices, we thought it would be useful for us to review the recent (1960-2020) history of crop exports.

We are old enough to have lived through the export boom of the early 1970s when the Soviet Union unexpectedly sought grain on the world market to make up for a crop production shortfall. Sensing a growing opportunity for US crops in international markets, then Secretary of Agriculture Earl Butz went on radio and television urging farmers to plant fencerow to fencerow.

Farmers responded to Butz’s request while exports did not live up to the rhetoric. In an inflationary era, prices flattened out; farm bankruptcies increased; and farm policy was used to reduce loan rates in attempt to recapture “our” export markets.

Given this history, we want to spend the next several weeks working through the history of exports since 1960, looking at one crop at a time.

First up? Corn.

As we have noted, corn benefitted from the entrance of the Soviet Union into the world crop market. The 1971 season average corn price was $1.08 per bushel. It went to $1.57 in the 1972 crop marketing year, $2.55 in 1973, and $3.02 in 1974. Other crops followed corn’s upward price trend. But we want to go back to the 1960s to set the stage.

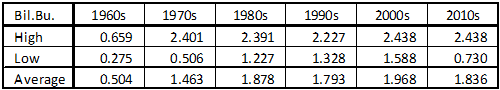

In the 1960s, a decade in which the season average price of corn varied from $1.00/bu. in 1960 to $1.24 in the 1966 crop marketing year, the average corn export level was 0.504 billion bushels with a high of 0.659 billion bushels in 1965 and a low of 0.275 billion bushels in 1960 (see Table 1).

Table 1. Corn exports: highest annual exports, lowest annual exports, and decadal average exports (million bushels), 1960s – 2010s. Source: compiled from USDA PS&D.

The 1970s were a different story, with the season average price of corn ranging from $1.08 to $3.02. The highest level of exports was 2.401 billion bushels in 1979. The lowest was 0.506 billion bushels in 1970 with an average export level of 1.463 billion bushels, nearly triple the average in the 1960s (Table 1). The expectations for exports and prices for the next several decades were set in the boom of the 1970s.

In the early 1980s, US corn exports fell from 2.391 billion bushels in 1981 to 1.227 billion bushels in 1985. The blame for this decline was laid at the feet of the nonrecourse loan rate, with its opponents arguing that the loan rate kept the US price above the world price, giving advantage to farmers in other corn-exporting nations.

Reducing the loan rate did not trigger the promised surge in exports and expected increase in farm profitability.

Export data for the 1980s through the 2010s can be seen in Table 1. What is clear is that in the 36 years since the adoption of the 1985 Farm Bill, US corn exports have exceeded their 1979 and 1980 crop year highs only 3 times including the 2020 crop year. The 2 billion bushel corn export level has been exceeded only 11 times over those years. Clearly the issue was not high loan rate levels.

So, what is going on?

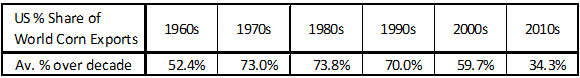

First, world corn exports peaked at 80.308 billion bushels in the 1980 crop marketing year and did not achieve that level again until the 2005 crop year. In the current 2020 crop marketing year, world corn exports are projected to be 185.701 billion bushels. As Table 2 shows, the US maintained its share of exports through the 1980s and 1990s with its share of exports declining in the 2000s and 2010s.

Table 2. US share of world corn exports, 1960s – 2010s. Source: compiled from USDA PS&D.

Second, non-US corn production which was 266.315 billion bushels in 1986 has increased by 507.483 billion bushels to 773.798 billion bushels in 2020, an increase of 191 percent. US production increased 72 percent. Undoubtedly, one factor in this dramatic increase in non-US corn production is the increasing use of production technology and seed genetics that were develop in the US over earlier decades.

With its fixed land base and farmers already using the latest corn production technology, the US role in world corn export markets will likely remain that of the residual supplier. As we see it, the chance of corn leading a long-term trend of export-based US farm prosperity is small to none.

Policy Pennings Column 1067

Originally published in MidAmerica Farmer Grower, Vol. 37, No. 313, March 12, 2021

Dr. Harwood D. Schaffer: Adjunct Research Assistant Professor, Sociology Department, University of Tennessee and Director, Agricultural Policy Analysis Center. Dr. Daryll E. Ray: Emeritus Professor, Institute of Agriculture, University of Tennessee and Retired Director, Agricultural Policy Analysis Center.

Email: hdschaffer@utk.edu and dray@utk.edu; http://www.agpolicy.org.

Reproduction Permission Granted with: 1) Full attribution to Harwood D. Schaffer and Daryll E. Ray, Agricultural Policy Analysis Center, Knoxville, TN; 2) An email sent to hdschaffer@utk.edu indicating how often you intend on running the column and your total circulation. Also, please send one copy of the first issue with the column in it to Harwood Schaffer, Agricultural Policy Analysis Center, 1708 Capistrano Dr. Knoxville, TN 37922.